Cancel your car insurance? Canceling car insurance has become increasingly easier. Car insurance policies can increasingly be canceled daily. This means you can often cancel within 1 insurance year.

Nowadays, car insurance can often be canceled online or by e-mail, without a cancellation letter.

You can switch insurers when the contract term has expired, but there are also other reasons to cancel. Switching is possible, for example, when selling a car or a collective premium increase.

How can I cancel my car insurance?

You can cancel your car insurance in various ways.

Are you taking out new car insurance? Sometimes the new insurer wants to cancel your old car insurance. Please inquire about this.

You can also cancel car insurance yourself. This can be done by sending a notice of termination to the insurer. This can be done using a cancellation letter or by e-mail. Some insurers offer an online cancellation service on their website.

Cancel your car insurance immediately

Your car insurance can of course be canceled when the contract period has expired. But there are more options for terminating and switching car insurance.

Your car insurance can be canceled immediately in 3 situations. You then have no notice period. These situations are:

1. Your car has been sold

Of course, you no longer need car insurance once your car has been sold. Selling a car is reason 1 to immediately terminate car insurance

When you transfer the car to the post office, you will receive an indemnity certificate. Send this indemnity certificate to the insurer to cancel the car insurance.

Send this indemnity certificate immediately. This way you prevent the insurer from being difficult about paying back the premium (premium refund).

2. Your car has been scrapped

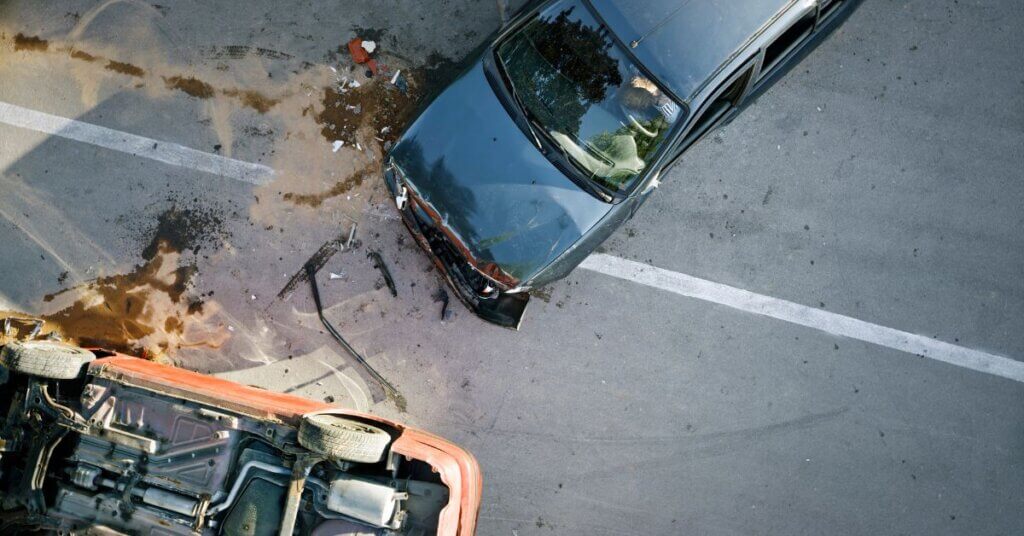

If your car has been scrapped, for example, because it is totaled, you no longer need car insurance. The scrapping of a car is reason 2 to immediately cancel car insurance.

You will also receive an indemnity certificate from the demolition company. Send this to the insurer to cancel the car insurance. Do this immediately to prevent the insurer from making a fuss about the premium refund.

3. Collective change of premium or policy conditions

Reason 3 to immediately cancel car insurance is a collective change in the premium or an adverse change in the policy conditions. This means that the car insurer increases the premium for all insured persons or policy conditions become worse for all insured persons.

In the event of a collective change, you have 30 days to cancel your car insurance.

If your premium is only increased, for example, because you fall back on claim-free years, you cannot immediately cancel your car insurance.

Cancellation and claim-free years

You build up a claim-free year for each claim-free insurance year. By canceling a car insurance policy after a few months and taking out a new one, the counter will start running again. You must then stay with the new insurer for 1 year to build up a new claim-free year.

It can be a shame to switch if your car insurance has already been in effect for 8 months. Then it may be smarter to wait a few more months and then switch. Some insurers, for example, if you have been insured for 9 or 10 months and have not suffered any damage, will give you 1 claim-free year when switching.

When you cancel your car insurance, your claim-free years are stored in Roy’s data. This is a national system in which all insurers can check how many claim-free years people have built up.

Your new insurer can then easily request your accrued years and use them for your new car insurance.

Sample letter: Cancellation of car insurance

Looking for a sample letter to cancel your car insurance? Place this information in a letter:

- Your data

- Your address details

- The polis-number

- The registration number of the car insurance that needs to be terminated

- The reason for termination (if applicable)

- Signature (optional)

Read also: Would You Like to Hire a Car Accident Lawyer?